IN SEARCH OF UNDER-PRICE HOTELS AND POSITIVE “ALPHA” IN INDONESIA

- Ross Woods

- Dec 21, 2022

- 2 min read

Updated: Feb 18, 2023

ID HOTELIER - In these turbulent times, it is easy for Indonesia's hotel developers and investors to overlook the most essential cornerstone of the capital markets: that expected returns are (and should be) greater for more risky assets.

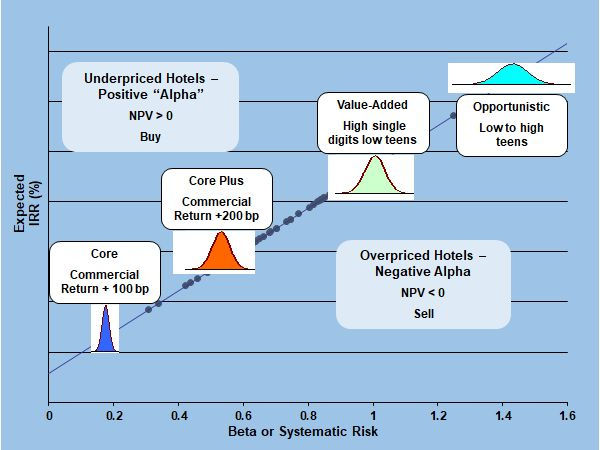

With a current construction pipeline of 252 projects/40,800 according to Lodging Econometrics (3Q2020), are Indonesia’s developers and owners targeting different pools of capital reflecting the different risk and reward investment strategies known broadly by terms such as “core”, “core plus”, “value-added” and “opportunistic”?

Hotel investors commonly believe, implicitly if not explicitly, that they are getting a higher expected return without assuming greater risk. If a hotel investor wants a higher return, the investor must accept more risk.

The extra return for a given level of risk is the ‘risk premium’ that is necessary to induce investors to invest their money in a hotel whose cash flows and terminal value are less certain. The risk premium is also defined as that part of the hotel’s total return that reflects the level of risk over and above the risk-free rate of return that an investor could obtain from a guaranteed investment, such as a government bond.

Now the analysis of return necessitates the analysis of risk. Both must be quantified before trade-offs between risk and return can be made. An “ideal” hotel investment is one from which the investor expects a high return rate relative to the perceived risk level and is found above the linear equilibrium pricing line illustrated in the accompanying graph. Every hotel investor is interested in investments with a weak – and therefore a favorable relationship between the expected rate of return and the expected level of risk.

A common misconception is that higher risk equals greater return. The risk/return trade-off means that with higher risk, there is a possibility of higher returns, but it does not guarantee them! The risk/return trade-off is therefore the balance between the desire for the lowest possible risk and the highest possible return.

Now to identify hotels likely to deliver high risk-adjusted returns or positive “alpha”, investors need some idea about what hotel values and expected returns should be in equilibrium. Without a theory and accompanying model of market equilibrium, it is doubtful whether investors can identify under-priced hotels, other than by chance. Intuition and discounted cash flow analysis alone, do not cut it when positive “alpha” is the goal.

About Writer

Ross Woods is a seasoned hotel investment advisor with over 30 years of global experience in hotel asset management, portfolio management, and hotel advisory services. Known for his collaborative-based consulting style that integrates a high level of strategic and analytical expertise, his “smarts” are sought by clients to solve complex issues, make better decisions and realize the highest risk-adjusted investment returns. His clients include banks, private investors, REITs and hotel management companies in the United States, South East Asia, Australasia, Europe, and Dubai.

Contact

Comments